Are you busy working, hoping to start a business, or going back to school?

Do you feel as if you’re going in every direction with many financial responsibilities? This is common for personal finance users, especially millennials. Many of us juggle our money, bills, and goals all in one place.

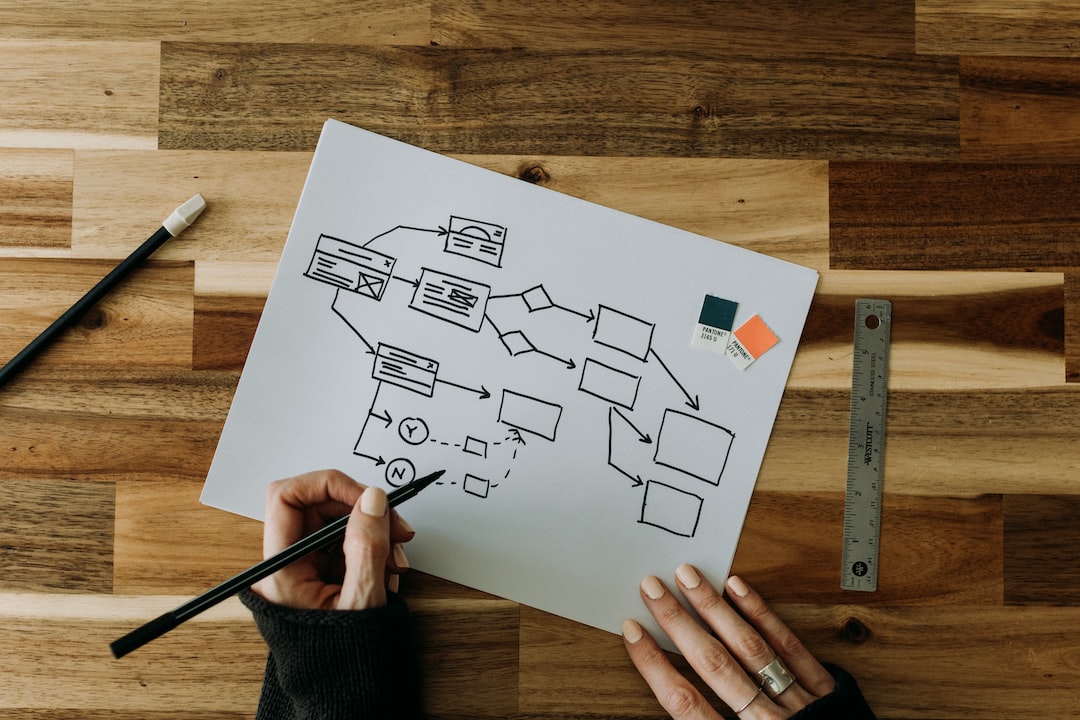

We can get overwhelmed by the various aspects of finance, and many of us may not know where to start. Luckily, there’s a fun and simple way to use a personal finance flowchart to manage your money.

Keep reading to learn how to utilize a personal finance flow chart so that you can stay on top of your finances.

Contents

Set Your Financial Goals

A personal finance flowchart helps you establish and manage your finances. To start using a flowchart, begin by setting your financial goals.

Take the time to sit down and evaluate where you are in terms of your finances and what you would like to achieve with them. Consider short, medium, and long-term goals, such as:

- Savings for an Emergency Fund

- Establishing Sufficient Retirement Savings

- Paying Off Debts

Once you have established your goals, the flowchart will help you to focus on which specific steps you need to take to reach them. Prioritize key objectives and budget plan a timeline for fulfilling them.

After writing down your objectives and charting a timeline, generate a budget and track spending to assess if it is helping you achieve your financial goals. With the help of a flowchart, you can more easily take control of your finances.

Choose a Timeline

Choose a timeline for your financial goals. Identify which financial goals are most important to you and those that are less important.

Next, decide when you want to accomplish each of your financial goals. This will allow you to have a timeline for every aspect of your financial plan. Use this timeline to break down your financial goals, such as:

- Short-term goals

- Mid-term goals

- Long-term goals

Short-term goals should be accomplished in a short timeframe, such as one month or a year. Mid-term goals could be accomplished over a few years, and long-term goals would take decades to accomplish. This timeline will provide an ongoing plan for achieving the different financial goals.

You should also use the timeline to mark existing debts or accounts you need to pay off and make a note of when the payments are due. This will help you stay on track with your goals and manage your finances responsibly.

List Out Your Income Sources

An essential step in this process is to list the income sources that you have. Start by creating a flowchart and then list out all of your income sources, such as:

- Salary

- Investments

- Business Profits

- Rental Income

- Interest Income

By listing out all of the sources of income, you can start to assess which sources provide the most inflows of money and which can be optimized for more income. Additionally, you can record any tax deductions associated with each income source and any tax withholding. This will help you stay organized and have a clear understanding of the money coming in during all periods.

Once all of your income sources have been listed, you can start creating the remaining steps for the personal finance flowchart.

Allocate Funds Appropriately

Using a personal budget flowchart is an excellent tool to help with allocating funds properly. First, determine the level of financial needs for savings, debt repayment, taxes, and other necessary items. Establish an emergency fund and save for long-term goals such as retirement.

Separating the money into different accounts can help to control money better. Also, consider how much is disposable income and budget it for monthly expenses.

Calculate how much to allocate for each line item of the budget. Adjust it as necessary or if the income changes.

When allocating funds, prioritize necessities first, followed by savings and debt repayment. Have a strategy to pay bills and always live within or below your means.

You must also identify spending patterns or discrepancies that will help you know where to focus when it comes to negotiating with the IRS. Knowing where you stand financially is key to navigating the complexities of the IRS.

Making wise and informed decisions about budgeting helps to develop sound financial habits and manage money more effectively.

Track Your Expenses

Tracking expenses is critical for a successful personal finance flowchart. The first step in tracking expenses is to monitor budget categories such as food, clothing, transportation, and leisure.

Every time an expense is made, it should be allocated to the appropriate budget category. This will keep track of monthly spending and help to ensure that the budget is not exceeded.

Additionally, it is important to keep track of any additional expenses that are incurred, such as when an unexpected expenditure arises. This will ensure that the budget is updated to reflect the new costs.

Finally, periodic check-ins with the budget should be done to make sure that expenses are not spiraling out of control. If any overspending occurs, action can then be taken to adjust budget categories and ensure responsible spending.

Monitor Your Progress

Make regular updates to your flowchart and use it to review your progress frequently. This can help keep you on track and help you to make adjustments if needed. Celebrate when you reach a milestone and adjust if needed if you find yourself off track.

If any changes are necessary, document them and adjust your chart. This will help you stay on top of your finances and ensure you are headed in the right direction.

Utilize a Personal Finance Flowchart Starting Today

A personal finance flowchart is an excellent tool to help manage and organize your finances. It will help you make better decisions and give you a clearer picture of your overall finances.

So what are you waiting for? Try creating a personal finance flowchart to gain more control over your financial future today!

Was this article helpful? If so, make sure to check out the rest of our site for more informative content.