Small business owners have to be creative and resourceful when it comes to financing their business. Not only do they need to know their options, but they also need to be shrewd in negotiating the best deals possible. Below are some tips on how to get a business loan.

When you need funding as a business, then a dti business loan may be an option for you. It pays to inject extra funds into a business whether you are looking to set it up initially, temporarily struggling financially, or looking to expand a business into new horizons. That extra money can make all the difference to your marketing campaign and being able to buy the right equipment to offer a quality service or product.

Small business owners have several options open to them when it comes to financing their businesses through loans. This compares to having investors or shareholders that have a stake in the company. To retain control of your business, consider the following options:

Bank Loans

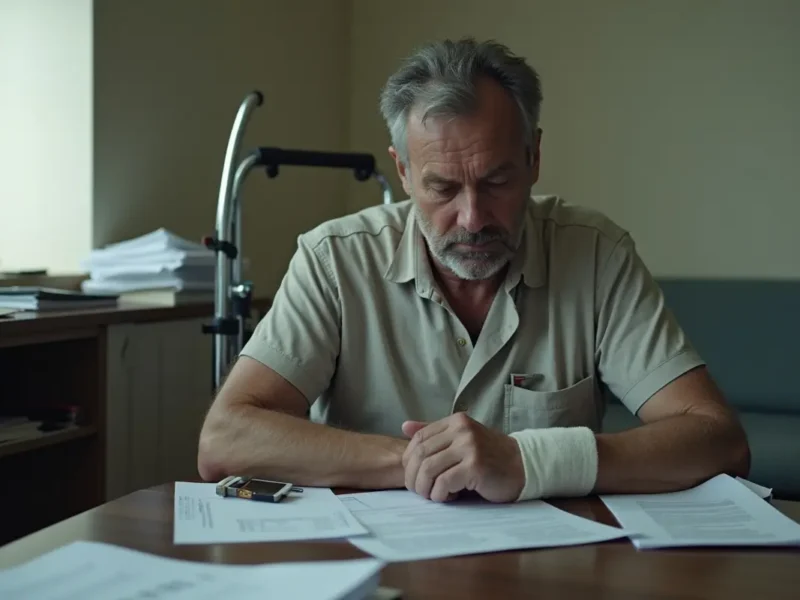

One option is a business loan from a bank or other lending institution. The terms of these loans can vary greatly, so business owners need to understand what they are getting into before signing any paperwork. Some things to consider include the interest rate, the length of the loan, and the amount of money being borrowed.

When applying for a bank loan, have a good business plan. This will include a cash flow forecast and projections of sales figures for at least the next three years. Do your homework to know your market and your competitors. A bank will want to know that you have considered how you will make money to pay back the loan within the required timescale.

Some loans can be secured, which means that you will need to put up collateral. Avoid this kind of loan if you do not want to risk your assets. For example, your home, which you could have re-mortgaged for cash anyway if you had wanted to go down that route.

Online Loans

Banks aren’t the only ones who offer business loans. Some online lenders specialize in small business loans. These lenders may have more flexible terms than traditional banks, and they may also be more willing to work with business owners who have less-than-perfect credit scores.

To improve your credit score to become more appealing to lenders, always pay your bills on time.

Friends and Family

Another option for small business owners is borrowing money from friends or family members. This can be a risky proposition, as relationships can be strained if things go wrong financially. But if done correctly, borrowing from friends or family can provide much-needed capital at a lower interest rate than what a bank would charge.

So, those are different sources to obtain a business loan. We can look to banks as the most common, but there are other ways. You have online to explore or simply ask those that you know if they would be interested in helping. Anyone who works for a business will already have a vested interest if they have space money that could be put to better use.

The advantage of a business loan is that it does not require a business to give up any of its equity. It is simply about financing a business through a system where money is lent in exchange for interest being paid on top of what is paid back.

As long as you can afford the monthly repayments and are prepared to pay for the privilege of the loan it is a good way for businesses to start up, survive, or expand. At times, it might just be a matter of a lack of cash flow that prompts a loan. Do not be too proud to ask for one. Online, you can do it more discreetly, if you wish.

No matter which option business owners choose, it’s important to understand the terms of the loan and be comfortable with the amount of money being borrowed. Business loans can be a great way to finance a small or large business.