As a loan officer, I know the constant pressure to find new clients. Mortgage brokers, retailers, and wholesalers all share the same core need: a steady stream of qualified mortgage leads. But the reality is often frustrating. The leads you buy can be unpredictable. Sometimes they don’t convert, and other times, they turn out to be fake or simply spam.

I’ve wasted my budget on leads that went nowhere. This challenge is why we must explore multiple channels to find potential borrowers. In this article, I’ll share how you can effectively get mortgage leads without spending a dime.

Contents

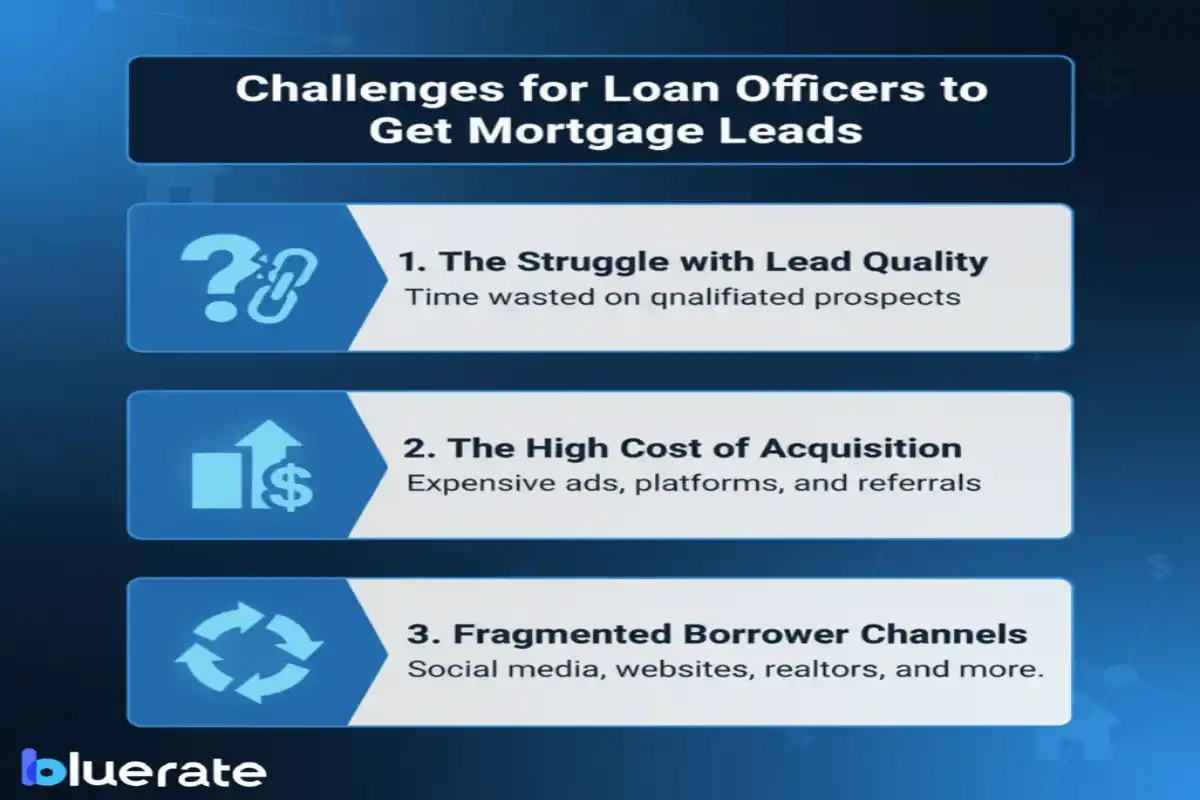

Challenges for Loan Officers to Get Mortgage Leads

Let’s break down the main challenges we face into three key facts.

The Struggle with Lead Quality

Finding a high-quality lead feels like searching for a needle in a haystack. The market is flooded with low-quality or completely fraudulent leads. I’ve encountered records generated by bots, filled with wrong numbers, duplicates, or even stolen personal information.

A major concern is “trigger leads,” which are sold by credit bureaus when someone applies for a loan. While they can be an opportunity, they are often abused by aggressive marketers, leading to consumer frustration. This not only drops your conversion rate but also increases compliance risks, making everyone more cautious.

The High Cost of Acquisition

The financial barrier to getting leads is significant. Industry data shows that a single mortgage lead can cost anywhere from a few dollars to several hundred, depending on its quality and exclusivity. On major platforms like Zillow, you can expect to pay between $30 to over $300 per lead. For a small business or an independent loan officer like myself, this is simply not sustainable.

If you try to generate leads through advertising, the costs are also steep. Pay-per-click campaigns on Google or Meta are becoming more expensive due to rising competition and privacy changes that limit targeting. Furthermore, the backend costs for processing an application, like pulling credit reports, add up. All these expenses eat into your net profit, making it harder to justify buying leads or lowering what you’re willing to pay for them.

Fragmented Borrower Channels

Today’s borrowers use many different paths to find a loan officer. Some prefer quick online comparison and instant applications, while others, like self-employed individuals with complex finances, seek a more personal, advisory service. This split means we have to manage both “cold” leads (less ready to act) and “warm” leads (highly interested). In my experience, the genuinely warm, high-intent leads are much rarer and more valuable, making them incredibly competitive.

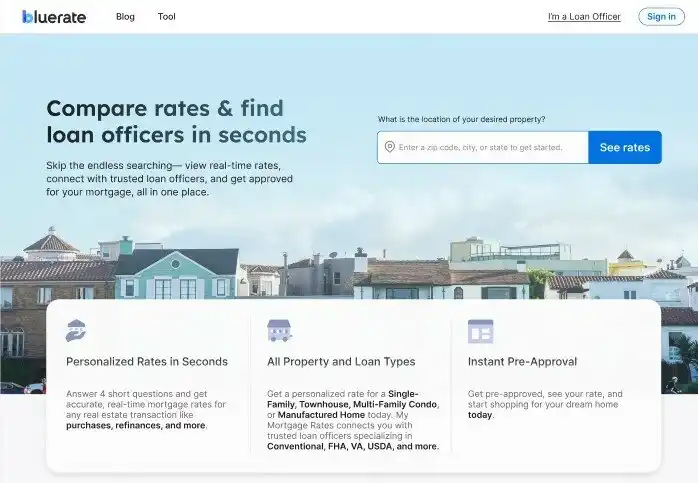

Bluerate.ai – Bridge Between Loan Officer and Borrowers

So, where can we find a reliable and free source of leads? This is where I found Bluerate.ai. Developed by Zeitro, Bluerate is a modern mortgage marketplace that directly connects loan officers with borrowers.

The platform allows me to create a comprehensive personal profile for free. I can showcase my professional background, my company, the loan types I specialize in, the states I’m licensed in, the languages I speak, and my key highlights. It’s like a professional landing page dedicated to my services. This profile acts as my 24/7 marketing tool, attracting potential borrowers and generating free leads. It’s already trusted by over 3,000 loan officers who have built their profiles.

For borrowers, it’s just as powerful. They can easily find and match with a local loan officer that fits their needs. They can input their details like credit score, estimated purchase price, down payment, and income, to check real-time rates and compare different scenarios directly on the platform.

Why Bluerate Stands Out for Loan Officers?

Here’s why I believe Bluerate stands out as a top solution for generating mortgage leads.

Completely Free and Zero Risk

The most significant advantage is that Bluerate is free for both loan officers and borrowers. I created my profile without any cost or commitment. There are no hidden fees, and Bluerate does not charge any intermediary commission when a borrower contacts me. It’s a truly no-risk way to build my online presence and attract new business.

High Quality and Strong Intent

The leads I get from Bluerate are high-quality because they come from borrowers who have taken the initiative to find and contact me. These aren’t cold calls from a purchased list; they are “warm” leads from people who are already researching and comparing rates. This clear intent makes them much more likely to convert, and I’ve personally experienced a higher closing rate with leads from this platform.

Effortless Lead Generation

Once I set up my profile, the platform does a lot of the work for me. Bluerate uses SEO to attract a consistent flow of organic traffic from people actively searching for mortgage options. I can literally “set it and forget it,” waiting for motivated borrowers to reach out to me directly. For an extra boost, I can also run my own Google or Meta ads to drive traffic specifically to my Bluerate profile.

Powerful Tools to Save Time

Beyond lead generation, Bluerate includes amazing tools that save me hours of manual work. Features like GuidelineGPT and Scenario AI eliminate 100% of the time I used to spend digging through guideline manuals. The platform helps achieve over 90% application completion rates from borrowers. On average, these tools save me more than 7 hours per loan, allowing me to close 30% more loans than before.

Integrated LOS and AI Speed

Bluerate integrates seamlessly with Loan Origination Systems (LOS). This means the entire process from the initial rate quote and connecting with borrowers to pre-qualification and the final application is transparent and efficient. The AI-powered system helps speed up the loan process. In my workflow, it has helped me close loans about 20% faster by streamlining these initial stages.

Conclusion

Getting quality mortgage leads doesn’t have to be a constant battle against high costs and poor quality. Based on my own experience, Bluerate offers a powerful, free, and efficient alternative. It connects you directly with motivated borrowers, provides tools to streamline your work, and ultimately helps you close more deals. If you’re looking for a smarter way to grow your business, I highly recommend creating your free profile on Bluerate today.