Life has a way of shifting in an instant. One moment you are following the usual rhythm of work, home and routine, and the next you find yourself navigating pain, paperwork and uncertainty after an accident.

Choosing Diamondback Funding Pre-Settlement Loans can offer a sense of grounding during this unfamiliar chapter. When medical bills arrive before you have healed and daily expenses continue without pause, having access to temporary financial support can make the journey more manageable while your legal case unfolds.

Contents

- 1 When your world feels paused but your bills do not

- 2 Why temporary help matters more than people realize

- 3 A structure designed for people in vulnerable moments

- 4 A practical option in a world with unpredictable income

- 5 How stability supports healing and clarity

- 6 A source of support when you need it most

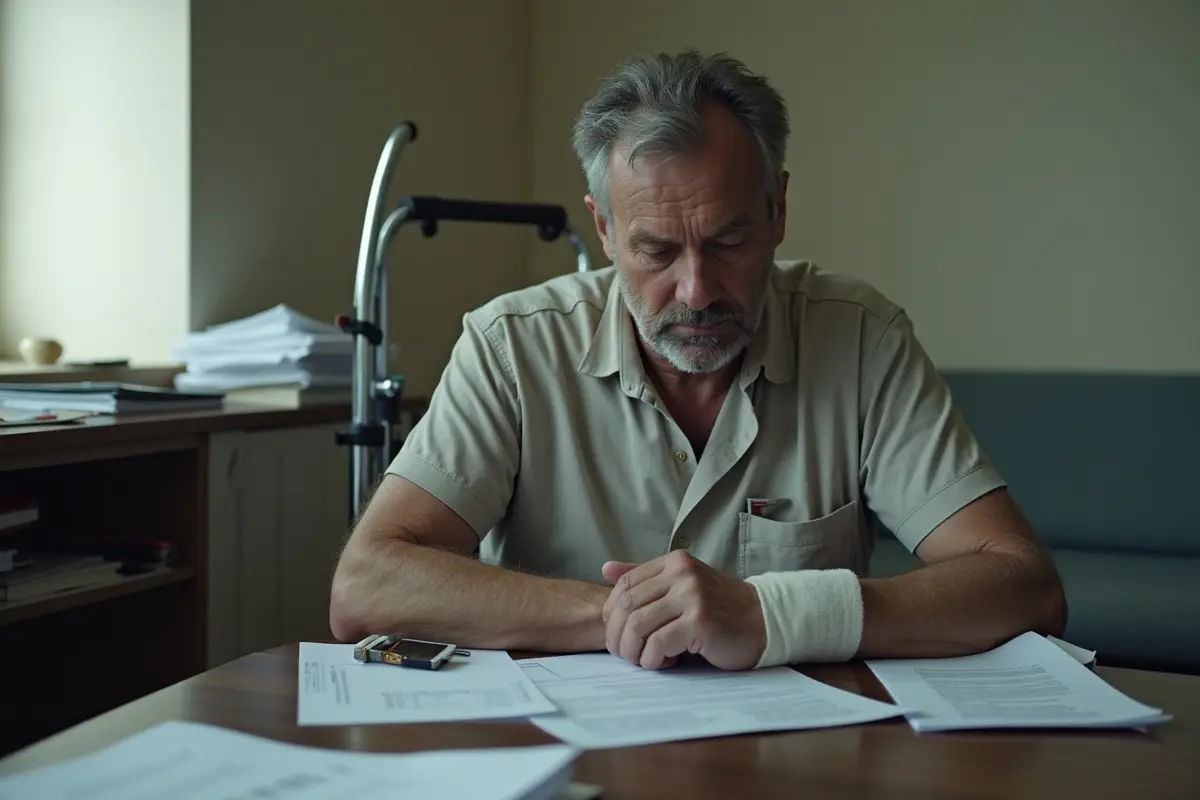

When your world feels paused but your bills do not

An injury is not just a physical event. It affects the way you move through each day. Simple tasks feel heavier, emotions shift and financial concerns begin to multiply. The legal process surrounding a personal injury claim often moves slowly because your attorney needs time to document the full story of your injuries. Meanwhile, your own story keeps moving, with all of life’s expenses following close behind.

Pre-settlement funding steps in at this delicate moment. Instead of relying on credit scores or uninterrupted employment, which may have been impacted by the accident, approval is based on the value of your pending legal claim. This makes the support accessible when traditional financial solutions feel out of reach.

Why temporary help matters more than people realize

When someone is injured and income drops, financial stress can quietly shape decisions that should never be rushed. Many claimants feel pressure to accept early offers because they cannot afford to wait. These early offers often fall short of covering long term medical needs, missed work and emotional impact.

This is where pre-settlement funding becomes more than a loan. It becomes breathing room, a small but meaningful gap between survival mode and clear thinking. With essential expenses managed, you gain the space to let your attorney gather the documentation needed to fight for a settlement that truly reflects what you have lost and what you need to rebuild.

People often use this type of funding to help with:

- Rent or utilities that cannot be delayed

- Medical appointments and rehabilitation

- Groceries and daily living costs during recovery

- Transportation while mobility or income is limited

Even modest support can reshape the emotional and financial landscape of recovery.

A structure designed for people in vulnerable moments

Pre-settlement funding is typically non recourse. If your case is not successful, repayment is generally not required. This feature matters because it protects individuals from deepening financial strain during a time already marked by uncertainty. Instead of creating more debt, the goal is to prevent additional hardship and allow you to move through your recovery without the constant fear of falling behind.

It is a gentler structure, acknowledging that healing takes time and that no one should be punished for circumstances beyond their control.

A practical option in a world with unpredictable income

Today, many people work in creative fields, gig roles, freelance jobs or flexible arrangements that depend on their ability to show up consistently. An injury disrupts that rhythm instantly. Traditional loans often require stable income and spotless credit histories, which makes them difficult to access right after an accident.

Pre-settlement funding shifts the focus to the case itself. This makes it a realistic option for individuals who contribute to the modern workforce in ways that do not fit conventional financial systems.

How stability supports healing and clarity

Recovery is rarely linear. Some days are filled with progress and others with setbacks. In this vulnerable mix, financial anxiety can become a constant background noise. By reducing that noise, pre-settlement funding makes room for deeper healing. It becomes easier to keep appointments, follow medical advice and make decisions aligned with long term wellbeing rather than short term necessity.

When life is already demanding your resilience, having even one source of stability can make a profound difference.

A source of support when you need it most

Pre-settlement loans provide more than temporary financial relief. They allow individuals to move through one of the most challenging periods of life with steadier ground beneath their feet. By easing immediate pressures and supporting the legal process, they help people protect both their recovery and their future. For anyone facing a long wait between injury and justice, this type of funding offers a meaningful sense of support, clarity and breathing room.