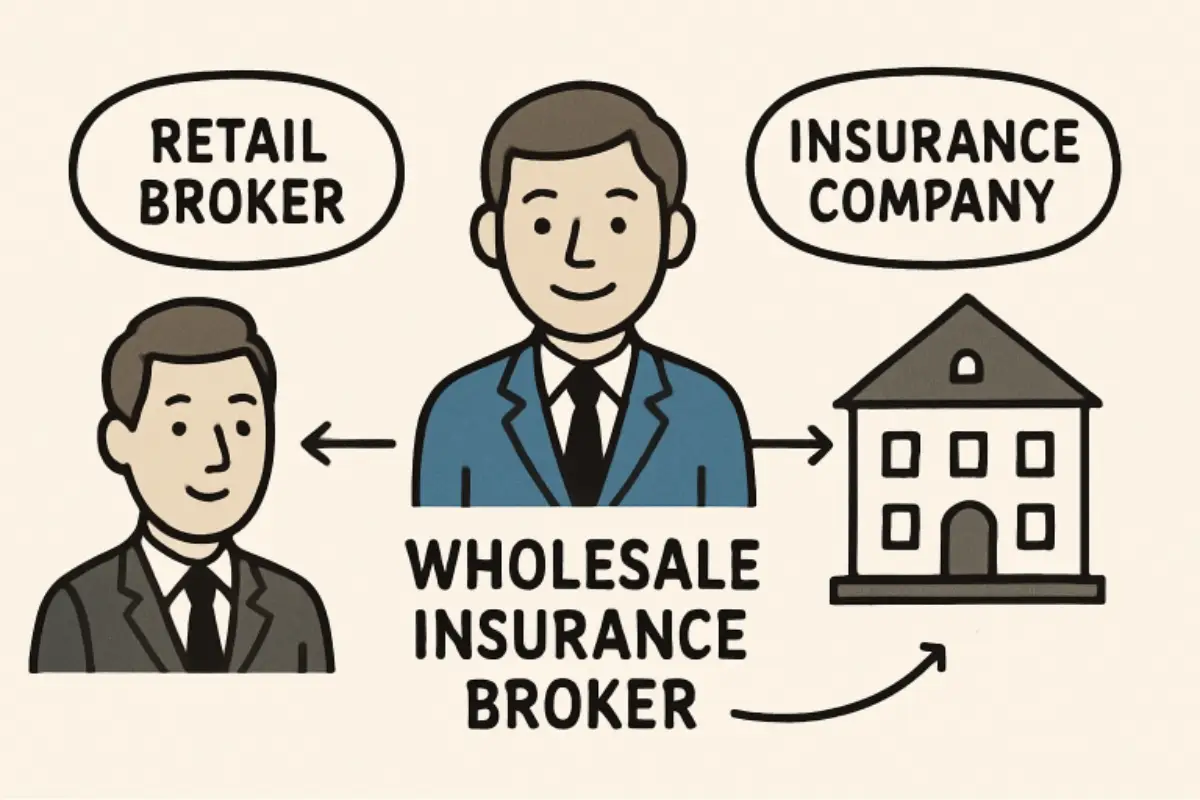

Navigating the intricate landscape of the insurance market often requires specialized expertise, especially when addressing complex or high-risk coverage. Wholesale insurance brokers fill this essential role, working as vital intermediaries between retail brokers and insurance carriers. With their in-depth industry knowledge and access to specialized insurers, these professionals help unlock solutions that standard channels might never reach.

Wholesale insurance brokers operate behind the scenes, but their influence resonates widely—driving innovation, facilitating faster underwriting, and ensuring clients receive coverage tailored to their exact needs. By connecting retail brokers to markets that are otherwise out of reach, they bridge gaps across industries and risk profiles, providing businesses with increasingly personalized and effective safeguards.

Contents

Role of Wholesale Insurance Brokers

The primary function of a wholesale insurance broker is to act as a knowledgeable intermediary connecting retail brokers with insurance carriers, particularly for clients whose needs are too complex or risky for standard insurance channels. This might include businesses in emerging markets, organizations facing unique risks, or high-value property portfolios that exceed the underwriting appetite of general insurers.

These brokers leverage longstanding relationships with multiple carriers to source coverage for hard-to-place or unconventional risks. By understanding carrier appetites, policy nuances, and current market trends, wholesale brokers can negotiate more favorable terms and create custom solutions that directly address client concerns. This role requires not just deep expertise, but also agility in adapting to market shifts and regulatory changes.

Services Offered

Wholesale brokers provide an extensive suite of services that distinguishes them from standard retail brokers:

- Access to Specialty Markets: Facilitating connections with insurers who focus on niche coverage areas or industries outside the mainstream.

- Customized Insurance Solutions: Designing bespoke policies for unusual exposures or high-risk industries where standard products are unsuitable.

- Risk Assessment and Management: Analyzing client operations to identify exposures and recommend efficient, effective risk management programs.

- Claims Advocacy and Assistance: Streamlining claims processes and supporting clients in obtaining timely, equitable settlements during disputes.

In addition to these core services, many wholesale insurance brokers now provide technology-driven solutions and data analytics to further enhance the speed, accuracy, and scope of their offerings. For more insight into these evolving services, industry updates from The Wall Street Journal’s Insurance News offer a valuable perspective.

Importance in the Insurance Market

In recent years, the influence of wholesale brokers has soared due to significant growth in the excess and surplus (E&S) lines sector. According to S&P Global Market Intelligence, U.S. E&S direct premiums written reached $86.5 billion in 2023, representing 9.2% of the country’s total direct premiums written. This remarkable surge underscores how wholesale brokers have become indispensable as businesses demand more flexible, innovative coverage than what standard markets provide.

By enabling access to alternative insurance markets and crafting tailored solutions, wholesale insurance brokers support economic resilience, facilitate business growth, and mitigate risks that would otherwise remain uncovered. Their expertise is particularly vital in dynamic industries such as technology, healthcare, and construction, where risks may constantly evolve and exposure levels often exceed what typical policies can handle.

Examples of Top Wholesale Brokers

The sector is marked by several leading firms recognized for their market presence and service innovation:

- One80 Intermediaries: Launched in 2019, One80 stands out for rapid growth achieved through strategic acquisitions and a commitment to delivering expansive solutions across the U.S. and Canada. By 2023, it earned a ranking as the fifth-largest MGA/underwriting manager/Lloyd’s coverholder in North America.

- Amwins: With deep expertise in challenging casualty risks, Amwins consistently provides tailored solutions for intricate and high-risk insurance needs, helping clients address exposures that require custom coverage forms and techniques.

Other notable competitors include CRC Group, RT Specialty, and All Risks, each contributing unique strengths in industry knowledge, specialist underwriting access, and client service models, as documented in Business Insurance’s Wholesale Broker Rankings.

How to Choose a Wholesale Broker

Retail brokers and clients looking to work with a wholesale broker should consider several key qualities:

- Expertise: Assess the broker’s industry-specific experience to ensure they can understand and address the client’s individual risk profile.

- Market Access: Review the broker’s relationships with a wide variety of insurers, so that multiple options and optimal terms are always available.

- Reputation: Investigate past performance, industry standing, and reviews from other clients to ensure reliability and trustworthiness.

- Service Quality: Confirm that the broker offers responsive support, from quoting through claims, and demonstrates real commitment to ongoing client needs.

Future Trends in Wholesale Broking

The landscape for wholesale brokers continues to evolve swiftly. Major trends shaping the industry include:

- Increased Reliance on Technology: Brokers are deploying digital tools and automation to drive quoting efficiency, accelerate claims handling, and deliver analytics-driven risk advice at scale.

- Growth in E&S Lines: As regulatory frameworks liberalize and business risks diversify, E&S lines are expanding, opening new markets for broker innovation and customized risk solutions.

- Focus on Specialized Coverage: From cyber risks to gig economy exposures and climate resilience, the sector is adopting agile approaches to address emerging industries and previously unheard-of perils.

Industry thought leaders highlight that data capabilities and a proactive approach to market change will define the next generation of successful wholesale brokers.

Conclusion

Wholesale insurance brokers serve as the vital connective tissue between the retail insurance world and specialized carriers, providing depth of expertise, expanded market access, and highly customized solutions for today’s complex and fast-evolving risk environment. Whether for rapidly growing industries, highly regulated professions, or clients with unique challenges, these brokers have become essential partners in meeting diverse insurance needs with insight and agility.