Understanding money and budgeting is critical when you have a business or are concerned about managing your budget. People consider it a simple task, but it may be pretty challenging. Suppose you plan a family trip. It would be best if you made complete plans before the journey. Similarly, preparing a financial strategy to make your future more accessible is essential.

For financial planning, it is advisable to hire a reliable advisor because these professionals have the relevant expertise and skills to make your future dreams come true by implementing the right investment strategies.

There may be instances when you have urgent needs, such as during the Covid-19 when most people were unemployed. During those periods, an effective strategy may save you.

Before you find the top benefits of hiring a monetary consultant, read this guide to find out what financial planning is and what you need to consider before implementing a strategy.

What is financial planning?

It can be described as a step-wise approach to achieving financial goals. In simple terms, it is a long-term strategy to keep a record of all your expenditures, income, and investments to accomplish monetary objectives.

Read below to find out the essential factors you should consider while planning.

Things To Consider

Preparing a financial plan involves a lot of factors, such as your future expectations, current assets, etc. Given below are a few things that are a must to consider.

Current Monetary Value

The primary concern is examining your current situation before preparing an efficient strategy. It would help if you accurately interpret your expenditure and income. It would be better if you also kept a note of any debts or additional savings. This step will help design a better plan.

Your Future Goals

The second important thing is understanding your future objectives. This assists in making a more straightforward strategy for achieving your goals.

Exploring Different Profitable Investments

Choosing the right and risk-free investment is essential. Many investment options, such as shares, NFTs, cryptos, mutual funds, etc., are currently on the market. An experienced planner may help you determine the profitable investment option depending on your current finances.

Reasons You Need To Hire A Financial Advisor

Having several years of expertise in the field, advisors offer various advantages, such as designing an effective plan to help achieve your goals.

Here are the top reasons why you need to consider hiring professionals.

Effective Planning

A monetary plan is one of the most crucial aspects for businesses and individuals. A highly qualified and experienced financial planner can assist you in designing an effective economic strategy.

Highly Experienced

Various trustworthy firms assist their clients. Since advisors are highly skilled, consulting them for your business or investment plans is worth consulting.

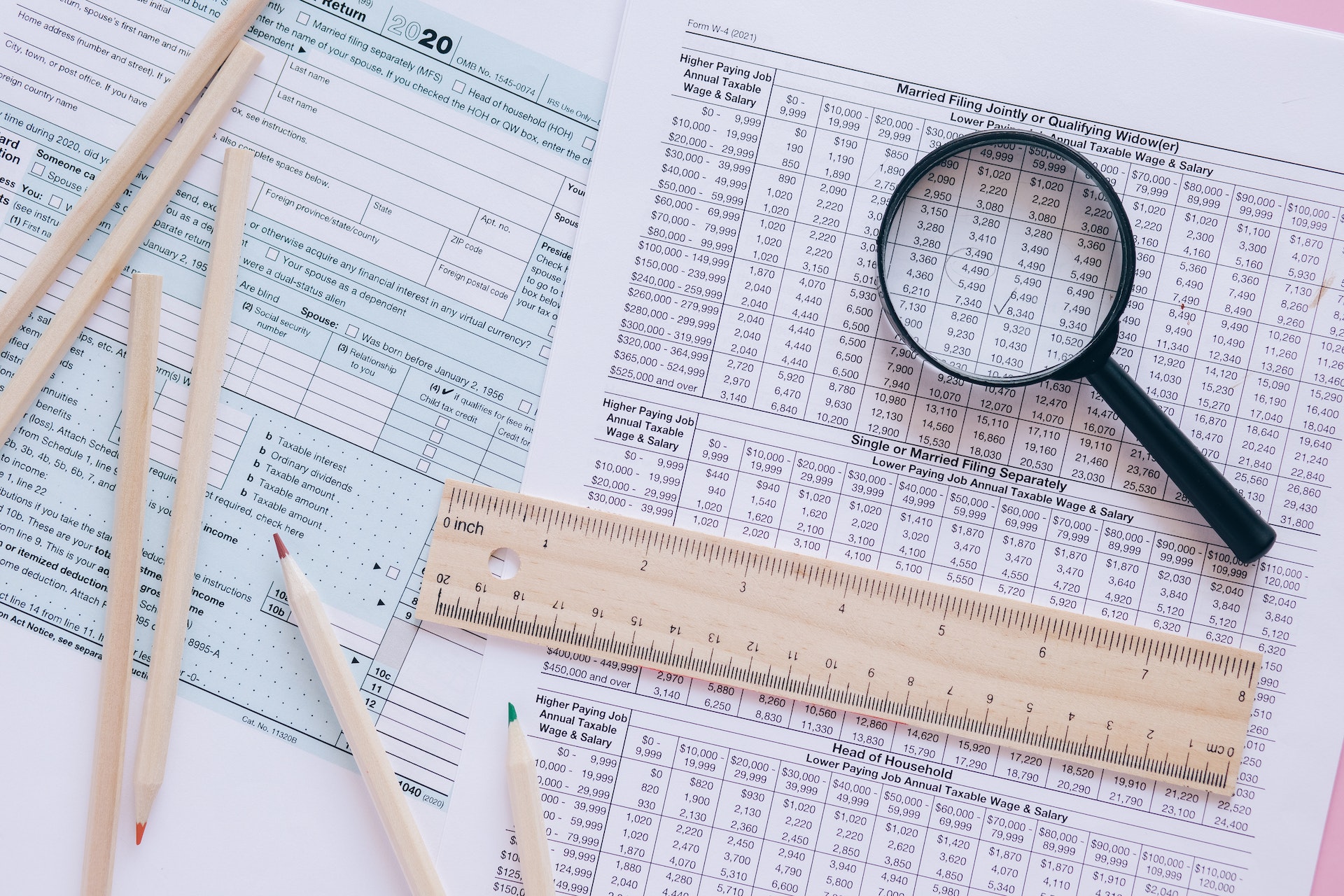

Improved Tax Planning

Business owners must identify ways in which they could legally lower taxes. Thus, advisors can help recommend tax-saving investment options. Also, you can determine strategies to lower your taxable income with their assistance.

Save Money

Monetary strategists can help save you a lot of money in the long run. Their effective strategies recommend ways to ensure maximum savings and minimum expenditure.

Conclusion

Effective planning demands a better understanding of your current situation and an analysis of your monetary objectives for the future. It can effectively be designed with the assistance of a planner. Several reliable companies offer qualified advisors to give you the perfect solution to make your financial journey better in the long run.